In an effort to underwrite more quickly and accurately, carriers are increasingly exploring simplified issue products, according to a new LIMRA study.

About 37.5 million U.S. households have no life insurance1 and companies are looking to tap into that market. One way to reach those who haven’t purchased life insurance is through simplified issue products.

The average turnaround time to issue a life insurance policy, including underwriting, is 28 calendar days. During this time, applicants often abandon the process. Simplified issue products can complete and issue a policy within minutes, hours or days of the application. Companies hope these products can diminish the attrition rate and issue more policies to consumers who need coverage.

There are a variety of types of life insurance offered on the simplified issue platform. Forty-one percent of the simplified issue products available fall under the universal life umbrella, 35% are whole life and 24% are term life products. These products use advances in data collection and predictive analytics to obtain better information and analysis of potential policyholders.

While some simplified issue products are offered directly online, none are primarily sold that way. Every company who sell through independent agents say independent agents were the primary distribution source for simplified issue products. In fact, 46% of simplified issue products sold were through the independent agent channel.

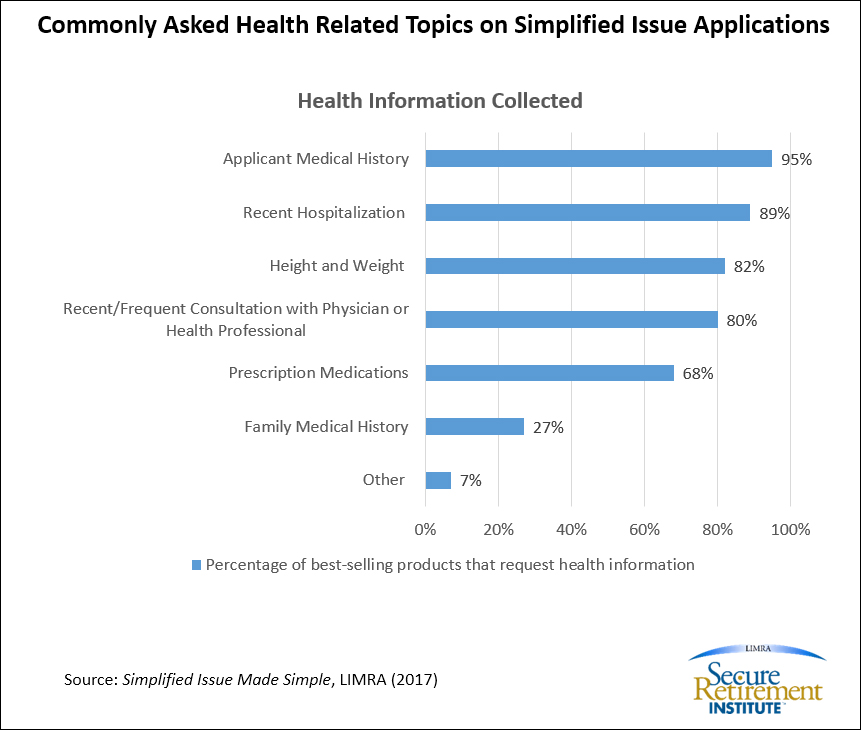

Simplified issue products keep the application process simple. Companies who sell these products rely more on the information provided in the application than on data collected from external sources. The simplified issue applications typically ask some health-related questions as well as lifestyle questions.

The most commonly asked health-related questions in the simplified issue application are regarding the applicant’s:

• medical history (95%)

• recent hospitalizations (89%)

• height/weight (82%)

LIMRA research discovered there was a broader range of lifestyle questions than health questions, however there were some topics that seemed to dominate. Ninety-one percent include a question regarding drug/alcohol use and 84% asked about tobacco use.

If an applicant fails the application process, most companies offer two potential outcomes. Either the applicant is flagged for follow-up process or they are disqualified from simplified issue products. Three-quarters of the simplified issue products researched had a formal follow-up process in place. However, just one-third of simplified issue products move disqualified applicants into full underwriting.

This report is based off individual simplified issue product data collected from 18 participating companies. The carriers provided data on their best-selling simplified issue product in each of the following categories: final expense whole life, juvenile whole life, other whole life, term, universal life, indexed universal life and variable universal life. Individual simplified issue products are defined as non-group life insurance products filed on an individual basis and sold outside the workplace or sold within the workplace where a policy is issued as opposed to a certificate.

To learn more about simplified issue products, LIMRA members can read the full report, Simplified Issue Made Simple.

1 Life Insurance Ownership in Focus: U.S. Household Trends 2016, LIMRA (2016)

- How to leverage generational diversity in teams - September 25, 2018

- Building your dream practice: How incremental progress can change your business - September 11, 2018

- How to develop a financial services practice through strategic acquisitions - September 5, 2018