There are currently about 108 million Americans with life insurance coverage through their workplace, compared to 102 million covered by individual life insurance, according to a new LIMRA study.

This marks the first time the number of people covered by workplace life insurance has surpassed those covered by individual since LIMRA has been tracking U.S. life insurance ownership in 1960.

Over the past 50 years the number of Americans covered by employment-based life insurance has increased significantly (9 million in the past 6 years alone) spurred by environmental forces such as population growth, workforce participation rates, and labor market conditions.

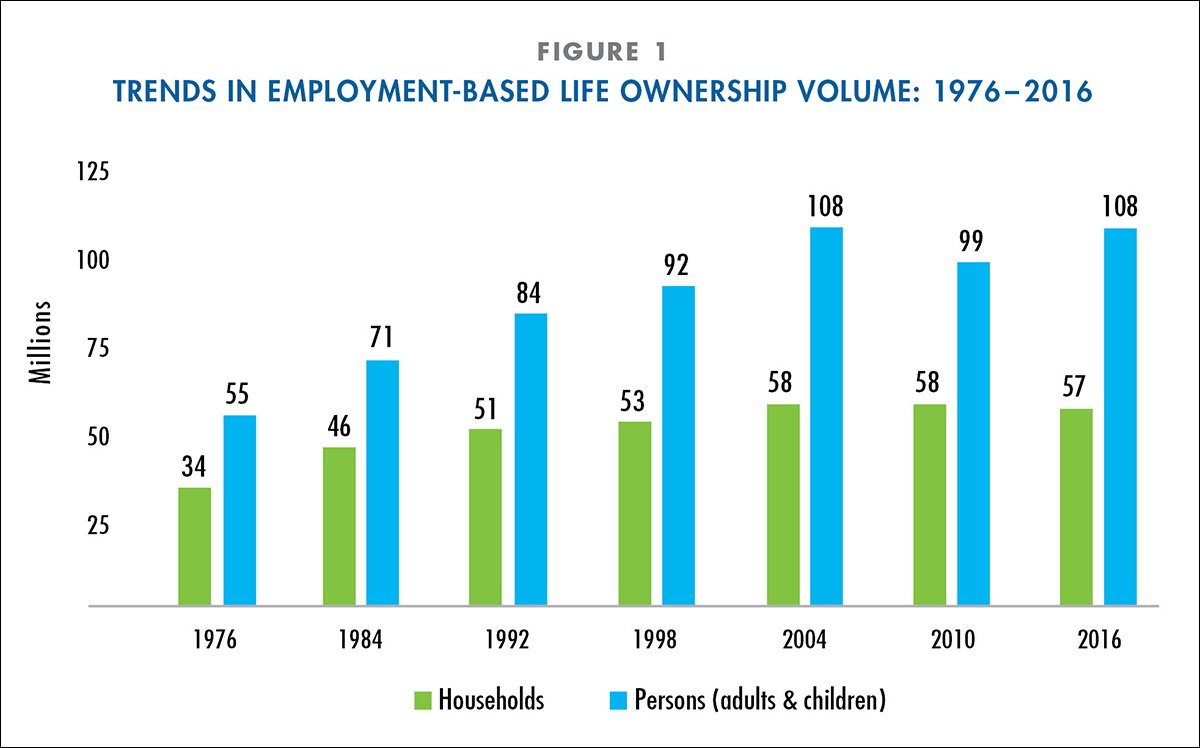

The number of households covered by employment-based life has increased by 68% (to 57 million), while the number of people (adults and children) covered has almost doubled (from 55 million to 108 million).

“Trends suggest the number of Americans covered by employment-based life insurance will continue to grow gradually,” says study co-author, Anita Potter, assistant vice president, workplace benefits, LIMRA. “However, growth in market penetration will be limited by population and labor force dynamics.”

The rate for employment-based life insurance peaked at 54% of American households back in 1984. Since that time, household market penetration has gradually declined, and now equals 46%. At the person-level (adults and children), market penetration increased steadily through 2004 when it peaked at 37%. The person-level ownership rate dropped by five-points in 2010, but has rebounded slightly and now equals 34%.

Americans overwhelmingly believe employers should be required to make life insurance coverage available (73%). Yet, the percent of employers offering coverage is gradually declining. Making matters worse, a dilemma facing the industry is that once employees make a benefit selection, most rarely revisit their decision and almost half (44%) never change their life coverage.

The study, Employment-Based Life Insurance Ownership Trends (2017), is based on a sample of 4,167 households. Respondents have primary or shared decision-making responsibility about finances, investments, and insurance in their household. The sample contains quotas for 30 age-income segments. The study sample was weighted to the U.S. household population by age, income, race and region.

- How to leverage generational diversity in teams - September 25, 2018

- Building your dream practice: How incremental progress can change your business - September 11, 2018

- How to develop a financial services practice through strategic acquisitions - September 5, 2018