Many individuals who were confident in their decision not to purchase optional employee benefits – such as short-term disability and critical illness plans – are not so confident once they have a little more information.

Recent LIMRA focus groups* show that employees such as these reconsider their decision once they receive more information on what plans such as STD and CI actually cover.

According to the research, too often employees connect short-term disability and critical illness coverage with their health benefits when they should be viewing them as plans to generate financial resources in the event of an unexpected health-related issue.

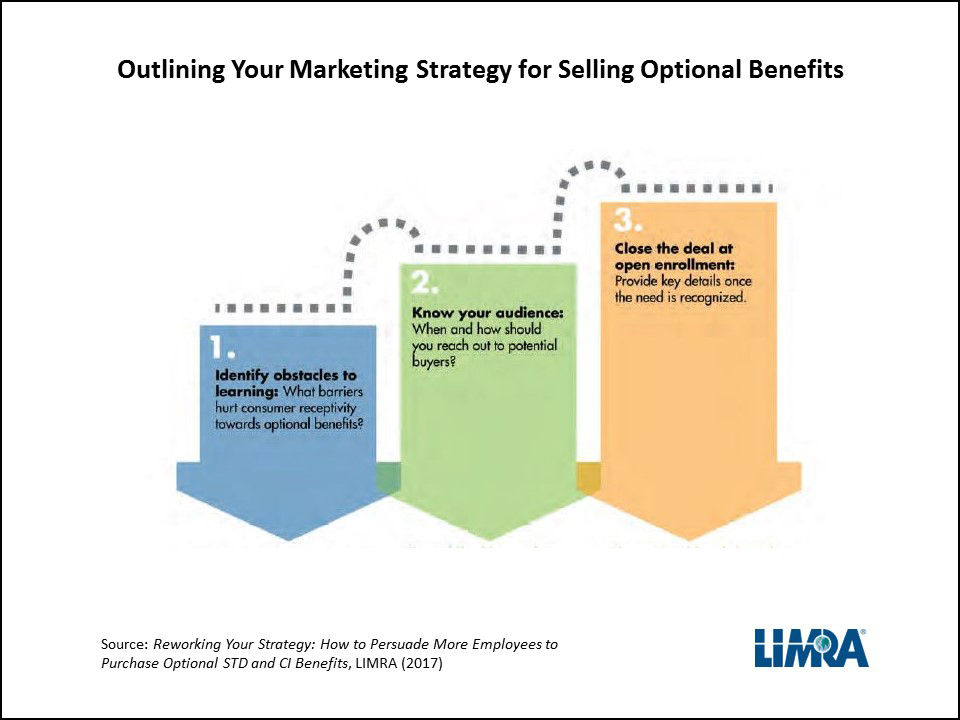

By associating short-term disability and critical illness plans with healthcare, consumers could be turning themselves off to coverage they need. Educating consumers on their coverage options would help them from associating their health risk factors with their need for coverage, or believing that the optional plans would overlap with their medical coverage.

Are you really reaching your consumers?

Contrary to most traditional worksite benefits marketing, which centers on the employer, efforts to sell optional benefits must instead focus on the individuals making the buy/no-buy decision – the employees.

When trying to gain the attention of employees, insurance agents and carriers shouldn’t limit themselves to only reaching them through their workplace. Today’s consumers use multiple channels to obtain information. They aren’t opposed to learning about their benefits via YouTube, Facebook, billboard advertisements and even face-to-face discussions with agents.

The key to connecting with employees is personalizing the message. Segmenting the audience to help them identify themselves in the message will help them see that the coverage isn’t really optional but rather something they need and makes sense for them.

While people will purchase optional benefits for multiple reasons, those who opt not to buy share similar views. Insurance providers need to personalize their marketing to potential clients and use concise positive messaging to reach their new prospects and reinforce the purchases to existing clients. By adopting a continuous education and communication approach, insurance carriers can significantly enhance their open enrollment participation rates for optional benefits.

*The report was based on eight online focus groups conducted in late 2016. The focus groups consisted of 44 employees with four groups focused on short-term disability and four on critical illness. All participants had access to one of these plans through their workplace.

About LIMRA: LIMRA, a worldwide research, consulting and professional development organization, is the trusted source of industry knowledge, helping more than 850 insurance and financial services companies in 64 countries. Visit LIMRA at www.limra.com.

- How to leverage generational diversity in teams - September 25, 2018

- Building your dream practice: How incremental progress can change your business - September 11, 2018

- How to develop a financial services practice through strategic acquisitions - September 5, 2018