There were some big changes this week in the life insurance trade media space, including one that marks the official end of the granddaddy of all life insurance magazines, National Underwriter Life & Health.

New York-based ALM Media, LLC, announced this week that the March 2017 issue was the final one for NU Life & Health, and that another of its magazines in the life & health space, Retirement Advisor, would also cease publication. ALM’s LifeHealthPro.com website has been folded into a “Life/Health Channel” on ThinkAdvisor, effective March 29, and ProducersWeb will be integrated into ThinkAdvisor on Friday.

Coupled with the fact that National Underwriter’s previous owner before it was acquired by ALM, Summit Business Media, decided to fold 87-year-old magazine Life Insurance Selling into NU Life & Health back in 2013, that’s a lot of well-known industry brands gone in less than four years.

I have a bit of unique perspective on this, as I got my start in the insurance and financial services media market with these very brands. Years back I was the Editor of Senior Market Advisor (rebranded to Retirement Advisor in 2014), moved on to become Editor of Life Insurance Selling for several years, was on the team that created LifeHealthPro by blending the content of SMA, LIS, and NU Life & Health into one site, and, after the decision was made to combine NU and LIS, briefly co-edited the new NU Life & Health magazine. I had seen the writing on the wall by then regarding their corporate strategy and moved on shortly thereafter – first to briefly edit Insurance Business America (bad fit) before happily landing at Insurance Forums in 2014.

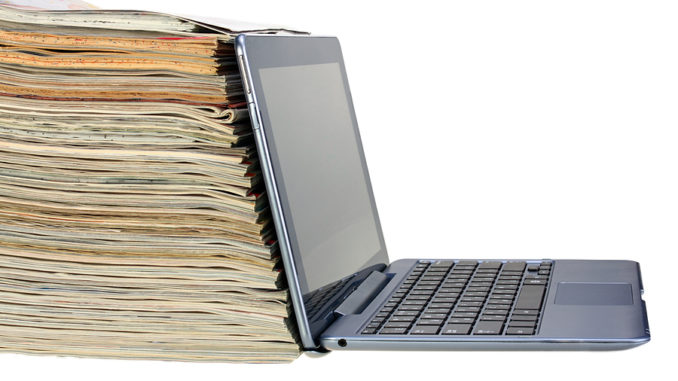

To make a long story short, I think the elimination of some of these long-standing and well-known brands deserves a little background. It’s no secret print magazines have been shrinking over the years as people have become accustomed to consuming information in a mobile format and advertisers want the tracking capabilities online provides, but I nonetheless find it kind of sad watching these once iconic pieces of industry history are fast becoming extinct. I fortunately got to share the long and distinguished 87-year history of Life Insurance Selling in its final issue in December 2013, but NU Life & Health will have no such tribute with the March 2017 issue being its final one, with no mention of it ceasing publication after 120 years.

So here’s a little more…

• National Underwriter traces its origins all the way back to 1897, when it debuted as Ohio Underwriter. Founder E. Jay Wohlegemuth would go on the road to solicit subscriptions and advertising before returning to Cincinnati to publish the next b-weekly edition.

By 1899, it published weekly under the name Western Underwriter, and took the National Underwriter name by 1917 as it grew to a national scope. It was the best-known brand among insurance professionals for decade upon decade through the 20th century.

• Life Insurance Selling was founded in 1926 by Editor and Manager Donald H. Clark of the Commerce Publishing Company in St. Louis. Clark was convinced of the opportunity and need for a specialized sales-idea magazine dedicated exclusively to the needs of life insurance producers. He sold two-year subscriptions for $1, or 10 cents for a single copy.

In the first issue, Clark wrote that the magazine, “does not merely aim to amuse you, to help you while away an idle hour. It has a definite and distinct purpose – it will try to increase your pep, inspire your insurance mind, and help you sell more insurance… The entire editorial contents each month will be devoted to articles on life insurance – and how to sell it.”

LIS grew to be hundreds of pages thick every month (266 pages in March 1984, for example) in the largely pre-Internet 1970s and early ’80s. It was packed with producer-driven peer-to-peer content featuring big industry names and popular columns like Harold P. Cooley’s “Why don’t you try this?” and Irwin “Burt” Meisel’s “Is This About Insurance?” along with long-running departments “Points that help you sell” and the MDRT-inspired “Million Dollar Sales Ideas.”

• Retirement Advisor was born as Senior Market Advisor in Sept. 2000 (rebrand was in 2014), and enjoyed a great run in the early part of the century by catering to the needs (and egos) of top annuity producers. Its monthly Producer Profile cover articles shared success stories of (sometimes) bling-laden elite producers and included lots of features and columns written by industry subject matter experts on all things annuities and practice management.

It also spawned the Senior Market Advisor Expo for a few years in Las Vegas (later renamed Advisor Network Summit), often headlined by popular producer/motivator Van Mueller.

• LifeHealthPro.com only came into existence in 2011 when the websites for print magazines National Underwriter Life & Health, Life Insurance Selling and Senior Market Advisor were merged into one site, but as magazine readers were more and more wanting instant access to information it quickly became a popular hub for content directed at independent life, health and annuity producers.

• ProducersWeb.com, for more than a decade, provided premium content, exclusive offers, information and services to the insurance and financial services industry. It was re-launched in 2010 to give producers the ability to create and share content with peers. Like other professional networking sites, ProducersWeb.com allowed users to follow each other and contribute blogs and content, generate leads, and gain insight to improve their sales and marketing strategies.

While ALM’s National Underwriter Property & Casualty and its PC360 website live on, as does the BenefitsPRO magazine and website, it’s still a remarkable consolidation of brands in the life and health market.

A statement on LifeHealthPro announcing the change said the move is an effort to “adapt a new client-centric approach that incorporates both insurance and investment solutions.”

My former colleague Allison Bell, now the Insurance Editor for ThinkAdvisor, says in a March 29 column that the change is because the life, annuity and health insurance industries have been changing in dramatic ways.

“Regulations, technology, business models, distribution methods, and client needs and expectations are shifting, especially in the life/health market, where agents and brokers find themselves moving to fee-based compensation arrangements,” Allison says in her column. She continues to say ALM can best the serve the needs of its life/health readers and marketers “with a single, more comprehensive brand…”

A brand – ThinkAdvisor – that has traditionally been the home of Investment Advisor and Research magazine readers has added this Life/Health Channel.

I get it. Media companies are in business to make money like everybody else, and you go where you think the money is. A market where carriers are strained by a prolonged low interest rate environment and regulatory uncertainty may not be able to support large editorial staffs of independent media companies covering specific markets like they used to.

But I’m glad Insurance Forums remains as an independent outlet committed to serving the unique needs and particular interests of the still very viable independent insurance producer distribution channel.

In 2015, independent agents held 50% of the new individual life insurance sales market, followed by affiliated (captive) agents with 39%, direct marketers with 6% and others accounting for the remaining 5%, according to LIMRA. Insurance agents, including career and independent agents, accounted for 37% of annuity sales in 2015 (also via LIMRA).

Yes, distribution is evolving. The proportion of individual life owners having purchased through direct-to-consumer channels hit 29% in 2015, the highest level ever recorded in the most recent edition of LIMRA’s U.S. Life Insurance Trends Study. Yet, most policy owners still purchase in-person from an agent – which is the way most people still prefer.

The 2016 Insurance Barometer Study survey by the LIFE Foundation and LIMRA found 88% of consumers use the Internet to research life insurance before purchasing coverage in 2016, but only 21% prefer to purchase online while half of consumers prefer purchasing life insurance in person from a producer.

At a time when multiple proposed government regulations threaten long-established business models, today’s independent insurance-focused producers need a trusted resource they can count on to deliver information and discussion on key issues that matter most to them. Insurance Forums will be there for them.

• Thoughts or comments? Please visit this thread: LifeHealthPro, ProducersWeb brands, mags shuttered

Brian Anderson is the Executive Editor of Insurance Forums

- Pacific Life takeover of former Genworth Lynchburg life operation helps stabilize the term market - September 7, 2017

- Insurtech Updates: Launches, expansions, partnerships and more - June 6, 2017

- Industry trade media brands disappearing: A closer look - March 29, 2017