Premiums for employer-provided health insurance are projected to increase at a rate of 5% per year over the next decade, according to a report released last week by the nonpartisan Congressional Budget Office (CBO).

In 2016, the average premium for employment-based insurance will be $6,400 for single coverage and $15,500 for family coverage, according to CBO and the staff of the Joint Committee on Taxation (JCT).

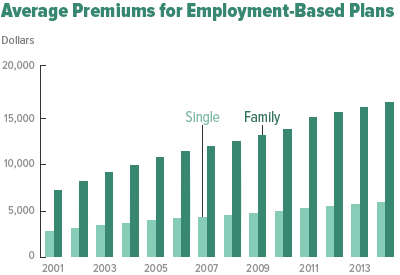

Over the period from 2005 to 2014, premiums for employment-based insurance grew by 48% for single coverage and 55% for family coverage. CBO and JCT expect them to grow at similar rates over the next decade. As a result, by 2025 the CBO projects average premiums will increase to $10,000 for single coverage and to $24,500 for family coverage — nearly 60% higher than 2016 costs.

“Average premiums for coverage purchased individually (in the non-group market) are also high—but not quite as high as average employment-based premiums, mostly because non-group coverage is less extensive and thus requires enrollees to make higher out-of-pocket payments when they receive care,” the CBO says in the report.

Other nuggets from the report:

• With nearly all premiums for employment-based insurance excluded from federal income and payroll taxes, the CBO calculates that the tax exclusion subsidizes roughly 30% of the average premium for employment-based coverage. On balance, CBO estimates, the tax exclusion increases average premiums for employment-based coverage by 10% to 15%.

• ACA tax credits to qualifying people buying on an exchange are projected to total about $40 billion in fiscal year 2016.

• “Together, the ACA’s regulations increase premiums noticeably in the non-group market and have more limited effects in the other markets. However, the non-group market represents a relatively small fraction of the total private insurance market, and according to CBO’s projections, it will continue to do so—accounting for about 15% in 2025. As a result, CBO expects that premium increases stemming from the ACA’s regulations will have a relatively small effect on the overall average of private health insurance premiums.”

• “Starting in 2020, a new excise tax (the “Cadillac Tax” which Congress recently delayed from 2018 to 2020) on employment-based plans with relatively high premiums is scheduled to take effect; for people who buy those plans, the tax will roughly offset the incentive to obtain more extensive coverage that the federal tax exclusion provides. Consequently, employers and employees affected by the tax are expected to choose less expensive coverage than they would have otherwise—and as a result, the tax is expected to reduce average premiums.”

• The excise tax will equal 40% of the amount by which annual premiums exceed the thresholds, which are projected to be about $10,800 for single plans and $29,100 for family plans in 2020.

- Pacific Life takeover of former Genworth Lynchburg life operation helps stabilize the term market - September 7, 2017

- Insurtech Updates: Launches, expansions, partnerships and more - June 6, 2017

- Industry trade media brands disappearing: A closer look - March 29, 2017